Our aim in The 2022 readability scorecard: Australian insurance companies is to compare the readability of documents produced by the largest insurance companies in Australia.

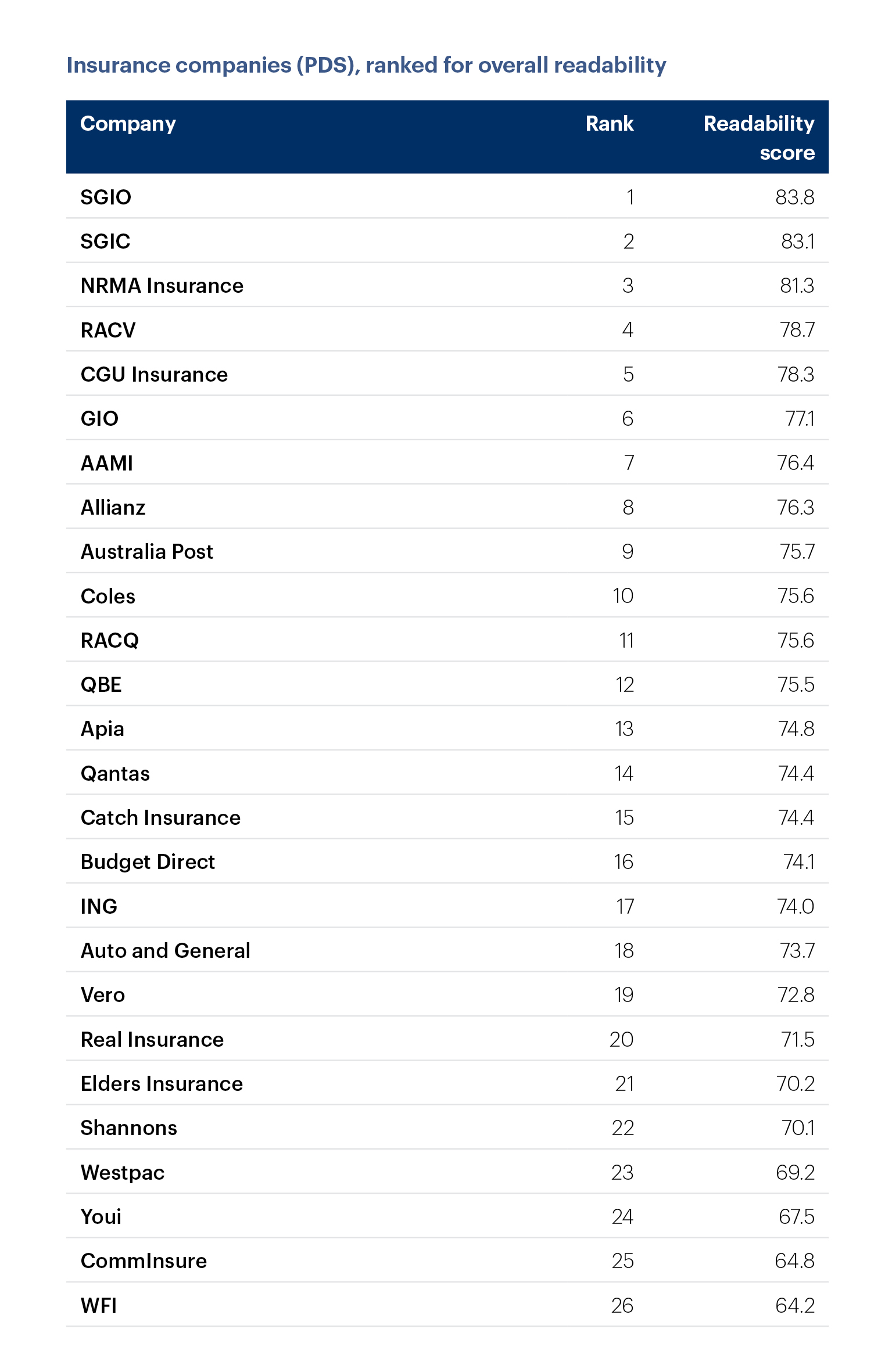

Ethos CRS analysed the readability of 52 publicly-available documents from 26 companies (documents published by insurers on their websites), and found all documents fell well below the ideal benchmark score of 100.

All insurers face the challenge of delivering complex information to a diverse range of customers, whose levels of financial literacy vary widely. Producing readable content is an important first step if insurers are to address this challenge.

Content is not easy to read

The readability scores for the documents of the 26 companies ranged between 64 and 83, with the overall average score being 74.3.

A readability score of 100 reflects writing that is easy to read. To achieve this benchmark is to communicate using plain language anyone can understand. Comprehension is compromised when sentences are too long; content is too wordy; or words are overly complicated.

Use the active voice more when writing content

On average, in the documents we examined, 72.9% of sentences were written in the active voice. This result falls below our benchmark of 95%.

Sentences were relatively short

Average sentence length was about 20 words per sentence across all 52 documents. This falls in the recommended range of 15 to 25 words.

Frequently Asked Questions case study

Customers might find the content of a PDS difficult to understand or want quick and easy answers about their policy. In this case, they might refer to a frequently asked questions (FAQ) webpage. We expected that an FAQ page would use plain English and short sentences, generating a much higher readability score.

While FAQ webpages on average scored slightly better results in our metrics, readability and clarity can still improve.

Download: The 2022 readability scorecard: Australian insurance companies (pdf)