Australian superannuation funds

The 2021 readability scorecard: Australian superannuation funds measured the readability of documents produced by the Australian superannuation sector.

The results are clear. Australian super funds can improve the readability of their public-facing documents by adopting the principles of plain language.

Superannuation funds face a challenge when communicating complex financial information with their members. Only 35 per cent of Australians know the actual value of their superannuation investment. Fund members are generally not financial analysts and some are not accomplished readers. Complicated language makes the task of understanding financial information difficult.

Content is not easy to read

The average readability score of the 20 super funds analysed was 45.6, which fell below our recommended benchmark of 100.

Readability was low

The average grade level score of all 80 documents analysed was 13.5, which fell below our recommended benchmark of 7.

Use the active voice more when writing content

On average, 68 per cent of sentences were in the active voice, which is below our recommended benchmark of 95 per cent.

Sentences were relatively short

The average sentence length of all documents was 21.9 words, which falls within our recommended benchmark of 15 to 25 words.

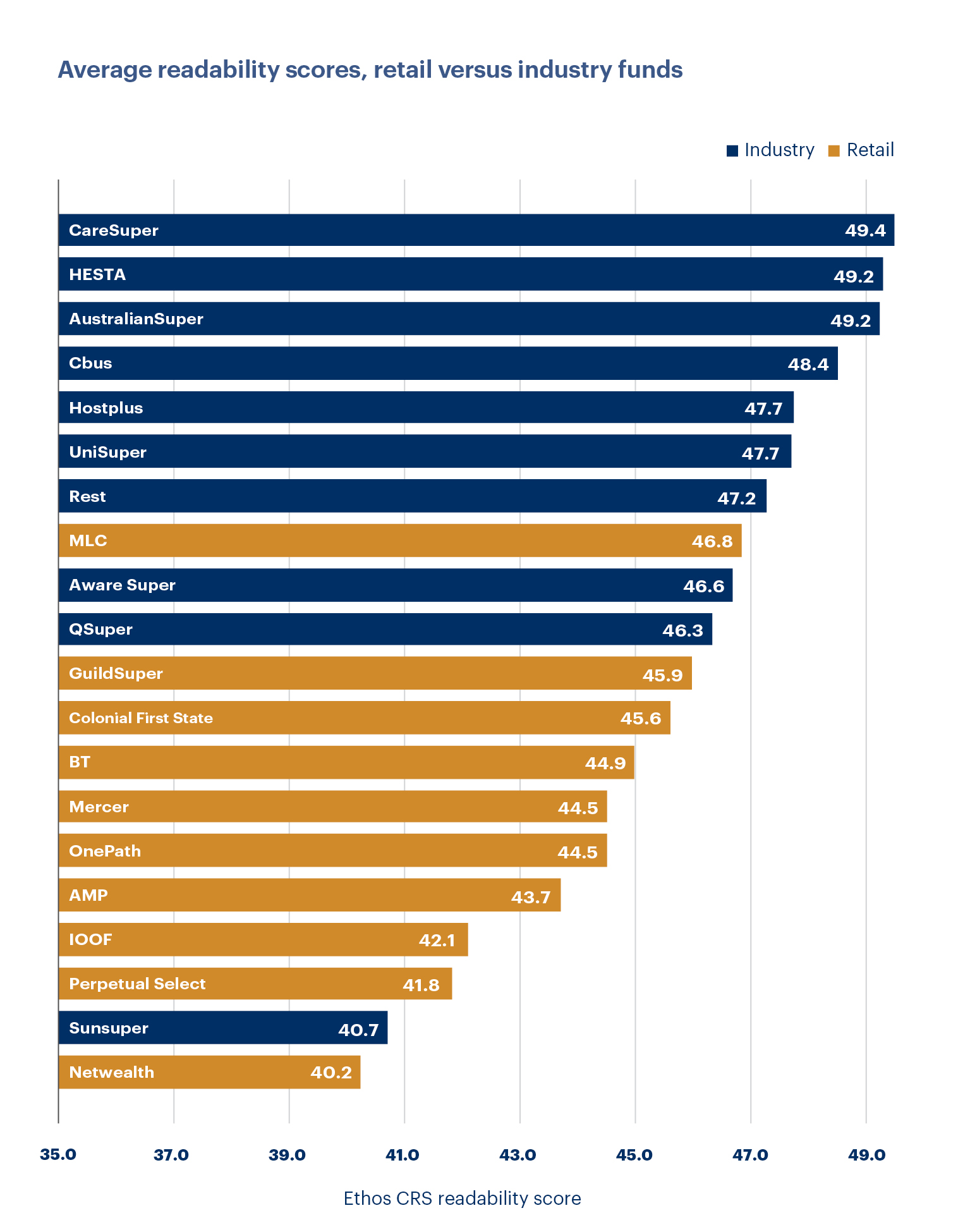

Scores for industry funds were generally better than for retail funds

The average readability score of documents produced by industry funds was 47.2. For retail funds the average readability score was 44.0.

Download: The 2021 readability scorecard: Australian superannuation funds (pdf)